Quickfire Financial Astrology | Member Requested Asset Analysis #3

Quickfire Astrological Analysis for Member Picks.

Executive Summary:

The following astrological analyses cover assets specifically requested by members of the Rowan’s Financial Astrology group chat. I have no affiliation with the entities analyzed herein and hold no vested interest or positions in these assets. These analyses do not constitute absolute predictions. They are intended as a quick-fire alternative analysis lens, akin to a weather report, to identify windows of high-probability momentum or structural friction. While the weather may be stormy or clear, the ultimate execution lies with the trader. We do not go as in depth as the regular articles.

⏱ A 10-Minute Read

ORIGINTRAIL ($TRAC)

OriginTrail is a crypto project that acts like a shared, trustable “Wikipedia for data” for companies, blockchains, and AI systems, rather than for articles. Instead of just tracking coins, its network helps different organizations publish, connect, and verify important real world information such as supply chain data or asset records, in a standardized format so AI can use it reliably.

The TRAC token is the currency that pays for using this data network (publishing and updating data, rewarding node operators, and staking for security), so as more useful data is added and used, the token is what powers that activity behind the scenes.

Origintrail sits in a niche between data, AI infrastructure and Web3 knowledge projects. It’s closest competitors are AI adjacent protocols like The Graph (GRT), Ocean Protocol (OCEAN) and the FET token.

In the macro-economics and macro-astrology, we see that 2026 so far is really punishing AI and tech stocks. Even industry powerhouses like AMD, who reported above expected positive earnings results, had their stock drop over 18% in early February before recovering.

As with many alt coin projects, and projects with a small market cap ($TRAC currently has a $161 Million Market Cap, a small size in crypto) these small projects are often more swayed by the movements of Ethereum than their individual astrology.

Origintrail actually had quite a positive Q4 in 2025 whilst the rest of the market slowly downsized, which tells us something about it’s ability to survive market downturns. That being said, it’s down 34% over a year, which is actually relatively strong compared to many other altcoin projects that have been destroyed recently.

Now, these smaller altcoins are likely going to be moved more by the price and astrology of Ethereum rather than their own charts. What is Ethereum doing in the near term?

Ethereum is still going through a tough Uranus-Saturn opposition. Saturn is dampening the hype of Uranus and bringing the doom and gloom. This opposition is still in effect until Uranus enters Gemini in April. In my view, April is the last chance saloon for any Ethereum surge before things get hairy for the rest of the year. Jupiter will conjoin the natal Mars by 27th May, which is generally bullish.

Looking at the chart for Origintrail, we can cast a chart based on the ICO (“initial coin offering”) for $TRAC: December 21st, 2017, 14:52 local time in Ljubljana, Slovenia.

Now, taking into account that the headwinds of Ethereum are much more likely to move the price of this coin rather than it’s individual astrology, we can see that within the $TRAC chart seems to have some strong astrology in mid to late April. Uranus ingresses into the 1st house, Venus is trine to the Moon from the 1st house, with Pluto conjoining the natal Moon. However, we must take this with a pinch of salt in the context of these charts moving more strongly with the headwinds of Ethereum.

Whilst 2026 might bring heavy damage to some altcoins, it’s also the perfect year for the winners to be separated from the losers, and to do research into the key projects which will survive and be used in the new financial system in the years to come. Early August could see a great buying opportunity before the potential of new money printing in Q4 2026 after an expected banking crisis, so research your altcoins and consider the strategy of DCA’ing in in early August. 2027 onwards will be much better for crypto in my view.

The fundamentals of $TRAC look bullish, but the macro headwinds and chart technicals are pushing this one down for now.

LITHIUM | LTH1!

Lithium futures contracts on the COMEX have had a huge 100% increase from last February, when they were trading for 8 dollars, and now in February 2026, trading for 16 dollars. Huge volume spikes saw a lot of traders head into the commodities surge this year. They are trading way above the 200 week moving average.

I am bullish on commodities of all kinds in 2026, but it looks like Lithium needs to return to the mean and have a bit of a correction sooner rather than later.

What chart can we use for Lithium futures contracts, specifically the Comex LTH1! ticker futures contracts?

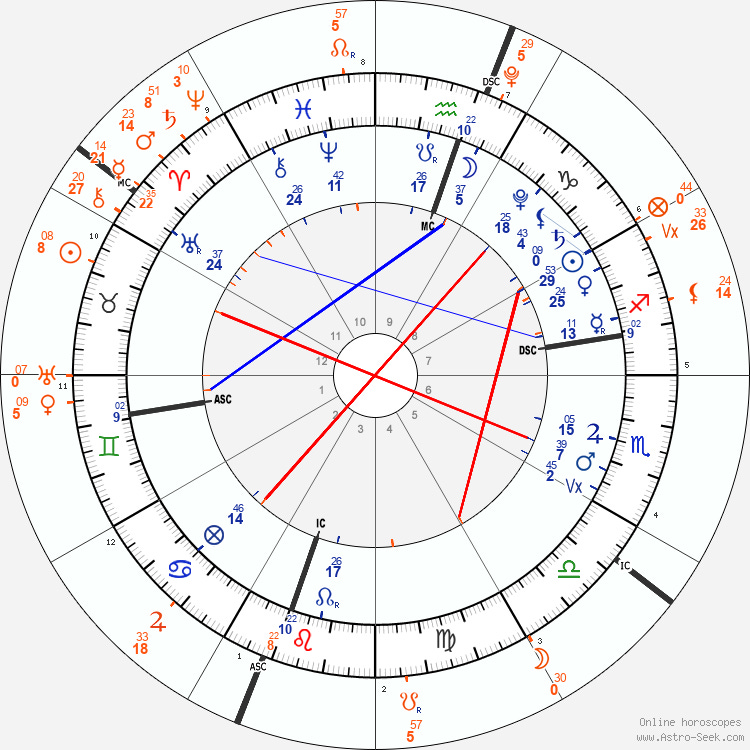

These specific lithium futures contracts launched trading on May 2nd 2021 at 17:00 PM in Chicago, Illinois. This marks the start of electronic trading of the lithium futures. This gives us the following chart: